Looking for the best location to invest in property in 2025? Explore the top Indian cities, micro-markets, investment potential, and key pros and cons of each region to make an informed decision.

Why Choosing the Right Location Matters in 2025

With increasing infrastructure development, evolving buyer preferences, and policy reforms like RERA and Smart Cities Mission, choosing the right location in 2025 will make all the difference in your real estate ROI. Whether you’re a seasoned investor or a first-time buyer, location is 80% of the game.

Best Locations to Invest in Property in 2025 (India Edition)

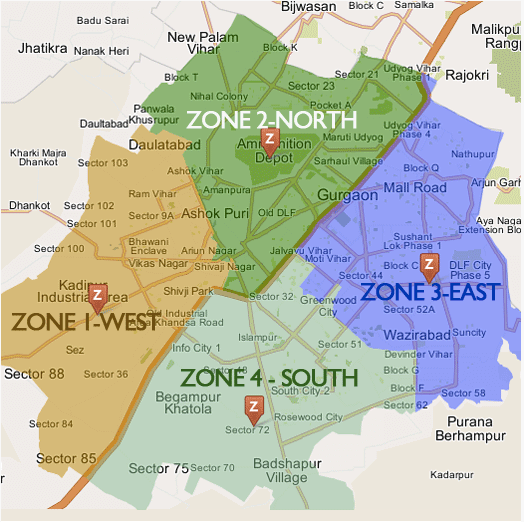

1. Gurugram – Sector 76, 79, Golf Course Extension Road

Why:

Gurugram continues to be the hotbed of luxury and commercial real estate in North India. With the rise of new launches like DLF Privana and the upcoming Cyber City 2, these sectors offer high appreciation potential.

Pros:

Excellent connectivity (SPR, NH-8, Dwarka E-Way)

Presence of top builders: DLF, M3M, Elan, Emaar

High rental demand due to corporate hubs

Cons:

High ticket size for premium segments

Traffic congestion in peak areas

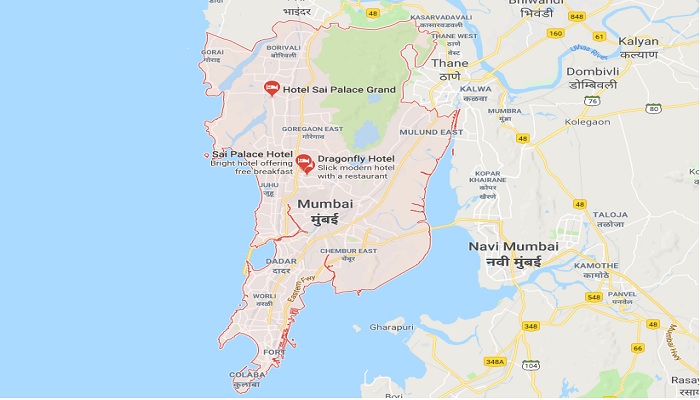

2. Mumbai – Thane, Panvel, Chembur

Why:

Mumbai’s satellite towns are booming thanks to Metro expansion, Navi Mumbai Airport, and affordable housing demand.

Pros:

Upcoming infrastructure (Metro Line 5, Trans Harbour Link)

Affordable compared to South Mumbai

Steady appreciation and rental demand

Cons:

Delayed possession risks in under-construction projects

Smaller carpet areas in mid-range flats

3. Bengaluru – North & East Bengaluru (Hebbal, Whitefield, Sarjapur)

Why:

Driven by the IT boom, Bengaluru remains a favorite among NRIs and salaried investors. Areas like Sarjapur & Hebbal are being transformed with tech parks and upcoming ring roads.

Pros:

Strong IT-driven job market

Competitive pricing compared to Mumbai/Delhi

Rental income potential is high

Cons:

Water scarcity in some regions

Delayed infrastructure in certain parts

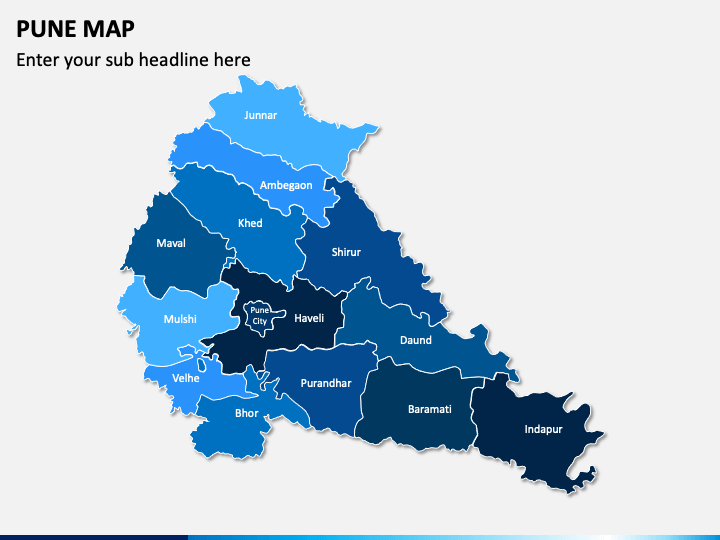

4. Pune – Hinjewadi, Wakad, Baner

Why:

Driven by the IT boom, Bengaluru remains a favorite among NRIs and salaried investors. Areas like Sarjapur & Hebbal are being transformed with tech parks and upcoming ring roads.

Pros:

Strong IT-driven job market

Competitive pricing compared to Mumbai/Delhi

Rental income potential is high

Cons:

Water scarcity in some regions

Delayed infrastructure in certain parts

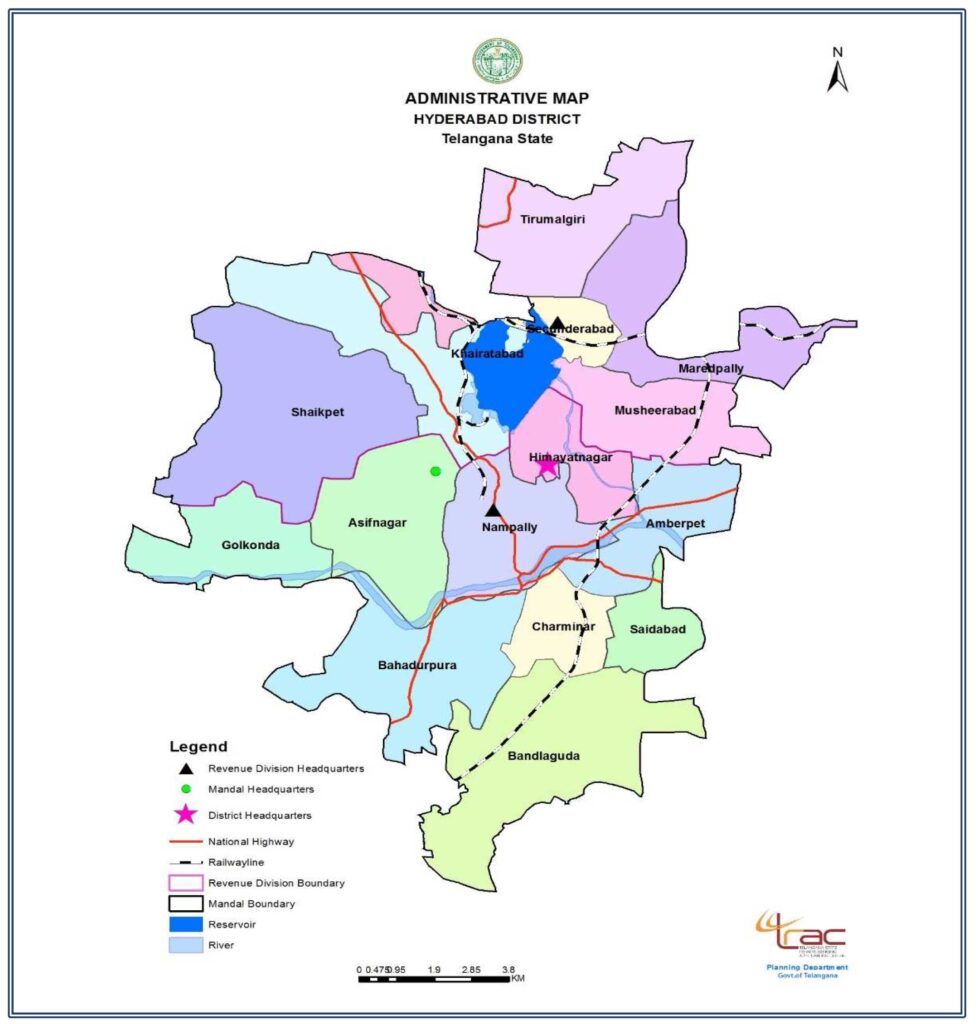

5. Hyderabad – Gachibowli, Kokapet, Hitech City

Why:

Hyderabad is emerging as a real estate favorite with lowest property registration cost among metros and an efficient municipal ecosystem.

Pros:

Affordable compared to other metro cities

Massive demand from IT & pharma sectors

Government-backed infrastructure push

Cons:

Limited investor awareness in North India

Fewer luxury housing options compared to Delhi/Mumbai

What to Consider When Choosing a Location in 2025

Purpose of Investment: Rental income vs capital appreciation

Developer Reputation: Choose RERA-registered and reputed developers

Connectivity & Infrastructure: Access to roads, metro, airports

Social Infrastructure: Schools, hospitals, malls

Legal Clearances: Avoid disputed zones or unauthorized colonies

Future Projects Nearby: Check for government-approved developments

Top 3 Locations by ROI Potential in 2025

| Location | Avg. Price/Sq.Ft | Rental Yield | 5-Year ROI Projection |

|---|---|---|---|

| Sector 76, Gurugram | ₹16,000–₹18,000 | 4.5%–5.5% | 2.5x – 3x |

| Whitefield, Bengaluru | ₹8,000–₹10,000 | 4%–5% | 2x – 2.5x |

| Thane, Mumbai | ₹10,000–₹14,000 | 3%–4% | 1.8x – 2.3x |

Conclusion: Where Should You Invest in 2025?

If you’re asking “What is the best location to invest in property in 2025?”, the answer depends on:

Your budget

Risk appetite

Whether you want short-term rental income or long-term capital gain

However, Gurugram (Sector 76–79) and North Bengaluru lead the way in terms of luxury, infrastructure, and long-term wealth creation.

Read Also: Why to Invest in DLF Privana